All Categories

Featured

Table of Contents

- – Who offers flexible Retirement Income From Ann...

- – Is there a budget-friendly Lifetime Payout Ann...

- – Who has the best customer service for Fixed V...

- – How do Lifetime Income Annuities provide guar...

- – How much does an Variable Annuities pay annu...

- – What are the tax implications of an Fixed In...

Note, nonetheless, that this doesn't state anything concerning changing for rising cost of living. On the bonus side, even if you assume your choice would certainly be to invest in the supply market for those 7 years, which you would certainly obtain a 10 percent annual return (which is much from certain, specifically in the coming decade), this $8208 a year would be more than 4 percent of the resulting small stock value.

Instance of a single-premium deferred annuity (with a 25-year deferral), with 4 payment options. The monthly payment here is highest for the "joint-life-only" choice, at $1258 (164 percent higher than with the prompt annuity).

The means you buy the annuity will certainly determine the solution to that question. If you get an annuity with pre-tax bucks, your costs reduces your taxed earnings for that year. According to , buying an annuity inside a Roth strategy results in tax-free settlements.

Who offers flexible Retirement Income From Annuities policies?

The expert's initial step was to develop a thorough financial prepare for you, and after that discuss (a) just how the recommended annuity fits into your overall strategy, (b) what choices s/he considered, and (c) exactly how such choices would certainly or would not have caused lower or greater payment for the expert, and (d) why the annuity is the remarkable choice for you. - Lifetime payout annuities

Of course, an advisor might try pressing annuities also if they're not the best fit for your circumstance and objectives. The reason might be as benign as it is the only product they sell, so they drop target to the typical, "If all you have in your tool kit is a hammer, rather soon every little thing starts appearing like a nail." While the advisor in this scenario might not be underhanded, it raises the threat that an annuity is an inadequate option for you.

Is there a budget-friendly Lifetime Payout Annuities option?

:max_bytes(150000):strip_icc()/Cds-vs-annuities-5235446_final-22b750a10bc94d4a9fd265b91553ef4c.png)

Since annuities commonly pay the agent selling them much greater compensations than what s/he would get for spending your money in common funds - Retirement annuities, allow alone the no commissions s/he 'd get if you purchase no-load shared funds, there is a huge reward for representatives to push annuities, and the extra difficult the far better ()

An underhanded advisor recommends rolling that quantity into brand-new "far better" funds that just happen to lug a 4 percent sales tons. Agree to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to do better (unless you selected even more improperly to begin with). In the exact same example, the advisor could guide you to purchase a challenging annuity keeping that $500,000, one that pays him or her an 8 percent commission.

The consultant tries to rush your decision, declaring the deal will quickly vanish. It may undoubtedly, but there will likely be comparable offers later on. The expert hasn't figured out exactly how annuity repayments will certainly be tired. The expert hasn't disclosed his/her compensation and/or the fees you'll be billed and/or hasn't revealed you the effect of those on your ultimate settlements, and/or the settlement and/or charges are unacceptably high.

Your household background and present wellness indicate a lower-than-average life span (Annuities for retirement planning). Present rate of interest prices, and hence predicted repayments, are historically low. Also if an annuity is right for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones offered by the issuing firm. The latter might need you to do more of your own research study, or utilize a fee-based economic consultant who might obtain settlement for sending you to the annuity company, but may not be paid a greater compensation than for other financial investment alternatives.

Who has the best customer service for Fixed Vs Variable Annuities?

The stream of monthly repayments from Social Security is similar to those of a delayed annuity. A 2017 relative analysis made an extensive contrast. The complying with are a few of the most salient factors. Since annuities are volunteer, the people purchasing them normally self-select as having a longer-than-average life span.

Social Security advantages are completely indexed to the CPI, while annuities either have no inflation security or at a lot of provide an established portion annual rise that may or may not compensate for inflation completely. This kind of motorcyclist, as with anything else that boosts the insurance firm's danger, needs you to pay even more for the annuity, or approve lower payments.

How do Lifetime Income Annuities provide guaranteed income?

Disclaimer: This short article is intended for educational purposes just, and should not be considered financial suggestions. You should get in touch with a financial specialist before making any kind of major monetary choices.

Because annuities are intended for retirement, tax obligations and penalties might apply. Principal Defense of Fixed Annuities.

Immediate annuities. Used by those who want reliable revenue promptly (or within one year of acquisition). With it, you can tailor earnings to fit your requirements and develop revenue that lasts forever. Deferred annuities: For those that wish to grow their cash over time, however are willing to postpone accessibility to the money until retirement years.

How much does an Variable Annuities pay annually?

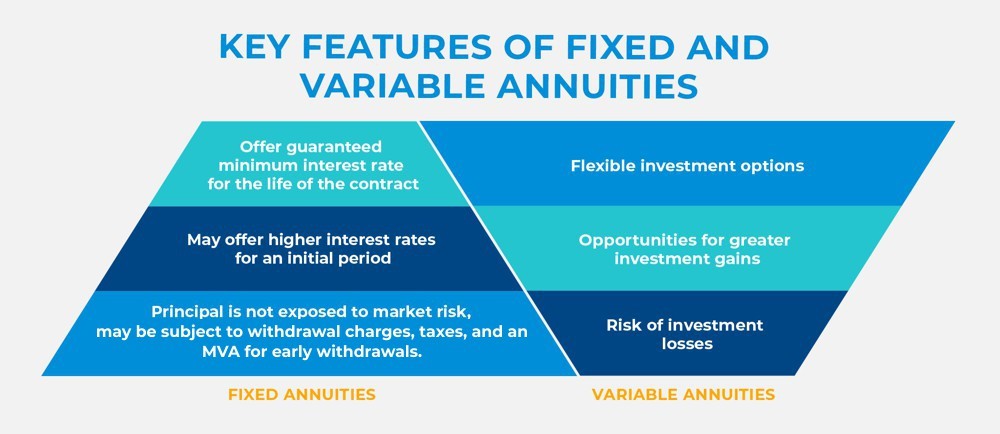

Variable annuities: Gives greater potential for development by investing your money in financial investment alternatives you select and the ability to rebalance your profile based on your choices and in a manner that straightens with altering financial objectives. With fixed annuities, the firm invests the funds and provides a passion price to the customer.

When a death claim accompanies an annuity, it is very important to have actually a named recipient in the agreement. Various choices exist for annuity survivor benefit, depending on the contract and insurance provider. Picking a refund or "period particular" alternative in your annuity supplies a death advantage if you die early.

What are the tax implications of an Fixed Indexed Annuities?

Naming a recipient other than the estate can aid this process go much more smoothly, and can assist ensure that the earnings go to whoever the specific wanted the cash to go to rather than going with probate. When present, a fatality advantage is instantly included with your contract.

Table of Contents

- – Who offers flexible Retirement Income From Ann...

- – Is there a budget-friendly Lifetime Payout Ann...

- – Who has the best customer service for Fixed V...

- – How do Lifetime Income Annuities provide guar...

- – How much does an Variable Annuities pay annu...

- – What are the tax implications of an Fixed In...

Latest Posts

Understanding Financial Strategies A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Benefits of Immediate Fixed Annuity Vs Variable Annuity Why Choosing the Right Fin

Exploring Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Fixed Indexed Annuity Vs Market-variable Annuity Breaking Down the Basics of Retirement Income Fixed Vs Variable Annuity Pros and

Decoding Fixed Vs Variable Annuity Pros Cons A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Fixed Annuity Vs Equit

More

Latest Posts